Marine

Marine Cargo Insurance is an insurance that covers the loss or damage to goods for the risks that may arise during shipping, in land (truck / container), sea (ship) or air (plane).

The risks involved in shipping goods are as follows:

-

Peril of the nature, danger that is closely related to the nature of the sea, land and air. For example: bad weather, typhoons, waves, etc.

-

Peril on the way, danger that may arise or occur during sea, land or air travel.

- Extraneous Risk, hazards that do not fall into the two categories above. Example: theft, destruction, etc.

Marine Hull

Water Transportation is a mode of transportation that is used 90% in the distribution of trade in goods, both local and international. Trade between countries have been going on since 3500 BC. Traders prefer to use water transportation to distribute their merchandise as it costs less than land or air transportation. So, currently there are a huge amount of ships in the world.

Water transportation is classified as a quite precarious type of transportation. Sea hazards that often threaten ships are bad weather, crew negligence, and ship fires. This danger can cause the ship to sink, capsize, crash into other objects, break, disappear, etc. Ship owners know they need protection from the dangers of the sea that threaten their ships. Based on this, starting from Lloyd's Coffee, ship hull insurance emerged providing protection against financial losses of ship owners for the possibility of ship accidents that occur during voyages. With a ship hull insurance, ship owners will have a peace of mind while the ship operates.

The ship hull insurance business in Indonesia recorded an average premium of IDR 1.5 trillion (AAUI Data 2015 - 2019). This gross premium figure certainly has the potential to grow in line with the improvement of the ship hull insurance portfolio and the presence of an adequate rate. Hull insurance is classified as having a high risk, given the average loss ratio recorded at 75% (AAUI Data 2015 - 2019).

In closing ship hull insurance, it is necessary to pay attention to a policy/ cover that is suitable and in accordance with the condition of the ship to be guaranteed by insurance. There are 3 standard covers that are often used, ITC Cl 280, ITC Cl 284 and ITC Cl 289. The cover of the ship's frame insurance is named peril, meaning that this policy will compensate for the losses suffered by the insured on the condition that the losses are caused by the guaranteed peril. Perils guaranteed in this policy are divided into 2 groups, Perils not subject to due diligence and Perils subject to due diligence. Due diligence is the steps that a person must take to fulfill his/ her responsibilities, for example someone must meet the applicable SOP, periodic maintenance of ship engines, and other obligations that must be fulfilled. Cover cl. 280, is the most extensive ship hull insurance cover. Because it is very broad, the cover cl.280 is often called the cover all risk.

The following is what is included in Perils not subject to due diligence:

1. Accidents in loading discharging or shifting cargo or fuel

2. Bursting of boilers breakage of shaft or any latent defect in the machinery or hull

3. Negligence of master officers crew or pilots

4. Negligence of repairers or charterers provided such repairers or charterers are not an assured hereunder

5. Barratry of master officers or crew

6. Breakdown of or accident to nuclear installations or reactors

7. Contact with aircraft or similar objects, or objects falling thereform, land conveyance, dock or harbor equipment or installation

8. Earthquake volcanic eruption or lightning

The following is what is included in Perils subject to due diligence:

1. Accidents in loading discharging or shifting cargo or fuel

2. Bursting of boilers breakage of shaft or any latent defect in the machinery or hull

3. Negligence of master officers crew or pilots

4. Negligence of repairers or charterers provided such repairers or charterers are not an assured hereunder

5. Barratry of master officers or crew

These perils also exist in cl.284 and cl. 289. Basically, these three covers are similar. The difference from the three is cl.280 guarantees both partial loss and total loss, while cl.284 only guarantees total loss. As for cl. 289, guarantees total damage, loss but does not guarantee collision liability and general average.

Indonesia Re has a large capacity to provide hull insurance coverage. With this capacity, Indonesia Re can assist insurance companies in increasing their ship hull insurance acceptance capacity. By prioritizing the right technical and business analysis, Indonesia Re has a very adequate underwriting system in the ship hull insurance business. This system is what can maintain the ship hull insurance business so that it remains profitable in the future.

Motor

Motor Vehicle Insurance is an insurance product that covers any loss or damage to two or more wheeled vehicles that own a license to use on public roads. Guarantees in motor vehicle insurance cover loss/ damage caused by crashes, one-party accidents, fire and theft. This coverage can be extended to include legal liability to third parties, personal accidents, riots, terrorism and sabotage, floods and earthquakes.

There are several factors that need to be considered to minimize the occurrence of losses initiated by the causes above, such as age, type and usage of motorized vehicles, territorial, to the insured's moral hazard.

In general, the coverage provided in Motor Vehicle Insurance is divided into 2 (two), among others:

- All Risk (Comprehensive): Covers the total or partial loss and/ or damage that occurs in motorized vehicles and guarantees the insured's legal responsibility for losses suffered by third parties which are directly caused by the insured's motorized vehicle.

- Total Loss Only: Covers any loss of motorized vehicles in the event of a total loss with an amount that has exceeded 75% of market value or is lost due to theft.

The types of coverage above have different rates and have been determined by the Financial Services Authority (OJK) in the Financial Services Authority Circular Letter Number 6 / SEOJK.05 / 2017 regarding Determination of Premium Rates or Contributions in the Property and Motor Vehicle Insurance Business Lines.

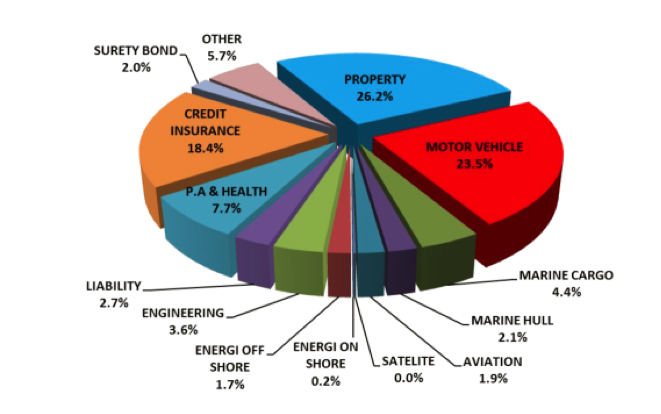

Based on data from the Indonesian General Insurance Association (AAUI), Motor Vehicle Insurance premiums dominate the market share of the General Insurance business line in Indonesia. This is shown in diagram 1.1 regarding the share of the general insurance premium market in Indonesia in 2018. The general insurance market share in Indonesia is always dominated by the Premium for Property Insurance and Motor Vehicle Insurance. This indicates that Motor Vehicle Insurance is in great demand and is needed by the market in Indonesia.

Indonesia Re, as a national Reinsurance company, always provides reinsurance protection/ solutions for General Insurance companies covering all general insurance products, one of which is Motor Vehicle Insurance Protection, both Proportional and Non-Proportional.

Property

Houses, buildings, warehouses, factories along with its contents are valuable properties with great financial value. These assets must receive maximum protection against all types of risk of loss caused by fire, landslides, earthquakes, floods, theft and other risks. There is nothing worse than a natural disaster or an unexpected man-made disaster that can wipe out income and destroy assets. Failure to provide protection for these assets can result in losses that can worsen financial conditions, especially if a person or company does not have a large enough emergency reserve fund.

Pic 1. A fire that occurred at PT Kansai Prakarsa Coatings in 2020

To protect property and get a peace of mind, owning good insurance protection is very important. In the bigger picture, insurance is a small expense that will bear the burden of large financial losses if something unfortunate happens to the property one owns.

Property insurance is an insurance that provides coverage for loss and or damage to the insured property and or interests in the form of buildings, machinery, merchandise (stock), contents or furniture and other building equipment (content) caused by or caused by Fire, Lightning, Explosion, Falling Aircraft, and Smoke or sometimes called FLEXAS (Fire, Lightning, Explosion, impact of Aircraft and Smoke) and other losses which are not excluded in the policy.

Property insurance can also be extended to other guarantees in the form of assurances for:

1. Riots, strikes, criminal deeds and riots (RSMDCC)

2. Floods, hurricanes, storms and water damage (FTSWD)

3. Earthquakes, tsunamis, volcanoes (EQVET, with separate policy); etc.

Based on AAUI Q4 2019 data, the property business class is the business class that contributes the most to insurance premiums with a premium composition of 26.2% and records a growth of 9.7% compared to 2018. Meanwhile, the property business class also contributes the largest reinsurance premiums with a premium composition of 52.88% and recorded a premium growth of 19.6% compared to 2018.

Pic 2. The composition of insurance premium in Q4 of 2019 according to AAUI data

Indonesia Re has an important role as a reinsurance company that provides protection for insurance companies against property risks. Indonesia Re is here to provide coverage for asset reinsurance both proportionally and non-proportionally. In 2019, the property business line contributed 33.58% of the premium of Indonesia Re. With increasing capacity, Indonesia Re is committed to continuing to increase participation in property insurance.

Casualty & liability

Casualty & Liability is an assurance that indemnifies the insured for all costs that are the insured's responsibility to be paid through compensation (including costs, fees and expenses of the claimant) regarding the injury to a person and damage to property from a third party as a result of events arising out of and in business implementation.

Engineering

Engineering insurance covers material damage and financial damage that follows in construction projects, machine installations, electronic equipment installations and civil construction.

A construction project has a number of threats of loss which determines the reputation and credibility of the contractor and project owner, while on a governmental scale this could be a source of loss for the state. From the threat of material loss and financial loss that can befall the components directly involved in the project and those around the construction area. Therefore, protection is required as a part of risk management in handling the existing potential risks. The potential for material losses that might occur is due to natural disasters (earthquakes, floods and storms), fire, and compensation from third parties due to damage caused by construction activities. Meanwhile, financial losses can be caused by profit lost, contractor defaults, and stalled projects.

Pic 1. The collapsed girder at the Tol Depok-Antasari project

Construction / erection all risk insurance provides guaranteed protection against material loss and financial loss that follows. Besides guaranteeing damage due to natural disasters, damage coverage can be extended to cover damage due to design errors, construction defects, and compensation for damage suffered by third parties due to construction activities.

Other classes in the engineering insurance group which are also managed by Indonesia Re are:

- Machinery Breakdown (MB) and Comprehensive Machinery Insurance (CMI) that cover damage related to machine installations

- Civil Engineering Completed Risk (CECR) that covers damage related to civil construction such as roads, bridges and piers

- Electronic Equipment Insurance (EEI) that guarantees damage related to the installation of electronic equipment

Miscellaneous

Asuransi Aneka (Misscelaneous Insurance) mencakup berbagai perlindungan yang dirancang untuk menjawab kebutuhan bisnis dan individu terhadap ancaman yang tidak dapat diprediksi, mulai dari kerusakan properti, gangguan usaha, hingga risiko-risiko khusus yang memerlukan penanganan teknis agar tetap berada dalam kendali.

Dalam lingkup asuransi aneka, perlindungan mencakup berbagai kejadian seperti kebakaran, pencurian, kerusakan akibat bencana, hingga tanggung jawab hukum terhadap pihak ketiga.

Aviation

Asuransi Pesawat Udara memberikan perlindungan komprehensif bagi operator aviasi, maskapai, maupun pemilik pesawat dalam menghadapi berbagai risiko operasional. Perlindungan ini mencakup kerusakan fisik pada pesawat—baik saat mengudara, melakukan manuver penerbangan, maupun ketika berada di darat—sehingga memastikan aset bernilai tinggi tetap terlindungi dari kerugian yang tidak terduga.

Selain itu, juga memberikan jaminan atas tanggung jawab hukum kepada pihak ketiga, termasuk kerusakan properti dan cedera non-penumpang yang terjadi akibat aktivitas penerbangan. Keselamatan penumpang pun menjadi prioritas, dengan perlindungan menyeluruh terhadap risiko cedera, cacat, atau meninggal dunia selama proses penerbangan maupun saat boarding dan disembarkation. Bagasi dan kargo yang berada dalam pengawasan operator ikut dilindungi dari potensi kehilangan atau kerusakan, menjaga kepercayaan pelanggan tetap terjaga.

Untuk risiko berintensitas tinggi seperti perang, sabotase, terorisme, hingga pembajakan, terdapat perluasan jaminan agar operasi aviasi tetap berjalan meskipun dalam kondisi penuh ketidakpastian. Perlindungan ini diperkuat dengan jaminan kecelakaan bagi awak pesawat saat bertugas, serta perlindungan tanggung jawab hukum yang timbul dari aktivitas ground handling dan perawatan pesawat di hangar, termasuk kerusakan pada pesawat milik pihak ketiga.

Dengan cakupan yang komprehensif dan fleksibel, Asuransi Pesawat Udara menjadi solusi terpercaya untuk mendukung keberlanjutan operasional, stabilitas finansial, dan ketahanan industri aviasi dalam setiap fase penerbangan.

10986

10986